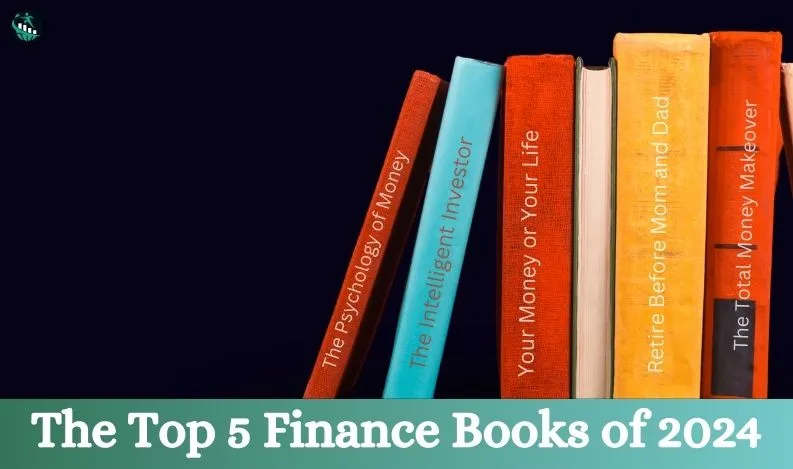

Transform Your Financial Future: The Top 5 Finance Books of 2024

In an age where financial landscapes are continually shifting and new economic challenges arise, arming oneself with the latest and most profound financial wisdom has become essential. The year 2024 marks a significant milestone in financial literature, with several groundbreaking books offering fresh perspectives and actionable strategies to navigate the complexities of personal finance, investment, and wealth management. Among these, five books stand out for their ability to not only impart knowledge but to transform the way we approach our financial lives.

The Psychology of Money: Unveiling the Intricacies of Financial Behavior

Morgan Housel's "The Psychology of Money" takes readers on an insightful journey into the depths of financial behavior, exploring the psychological underpinnings that influence our financial decisions. Housel, with his eloquent narrative and relatable anecdotes, delves into topics such as wealth accumulation, the impact of luck and risk, and the importance of making peace with uncertainty. He emphasizes that understanding the psychological aspects of money is just as crucial as the technical know-how.

Key Insights:

● The role of personal history and psychology in financial decision-making

● The significance of long-term thinking in building wealth

● The impact of societal norms and expectations on our financial behaviors

The Intelligent Investor: The Definitive Book on Value Investing

Benjamin Graham's masterpiece, "The Intelligent Investor," has been the cornerstone of investment strategy since its first publication. Renowned for introducing the principles of value investing, Graham's book is a treasure trove of wisdom for investors looking to navigate the stock market's vicissitudes with prudence and a long-term perspective. The book's enduring relevance lies in its foundational investment philosophy, emphasizing financial discipline, thorough analysis, and the intrinsic value of stocks.

Key Insights:

● The distinction between investing and speculating

● The concept of "Mr. Market" and the importance of market temperament

● Strategies for defensive and enterprising investors

Your Money or Your Life: Transforming Your Relationship with Money

"Your Money or Your Life" by Vicki Robin and Joe Dominguez is a groundbreaking book that challenges readers to reassess their relationship with money and envision a new path toward financial independence. This book is more than a guide to managing finances; it's a call to transform your life by changing how you perceive and interact with money. Through a series of reflective questions and practical exercises, the authors guide readers through a nine-step program designed to foster a more meaningful and intentional approach to personal finance.

Key Insights:

● The concept of "life energy" and its trade-off for money

● The importance of aligning your spending with your values

● Strategies for achieving financial independence and a fulfilling life

Retire Before Mom and Dad: The Simple Numbers Behind a Lifetime of Financial Freedom

Rob Berger's "Retire Before Mom and Dad" demystifies the complex world of personal finance, making the dream of early retirement accessible to everyone. Berger, with his straightforward and engaging writing style, lays out a clear, step-by-step plan that focuses on the fundamentals of saving, investing, and spending wisely. The book is filled with practical advice, real-life examples, and simple calculations to help readers set and achieve their financial goals.

Key Insights:

● The power of compound interest and how to leverage it for long-term growth

● The importance of living below your means to accelerate financial independence

● Investment strategies for building a robust retirement portfolio

The Total Money Makeover: A Proven Plan for Financial Fitness

Dave Ramsey's "The Total Money Makeover" provides a no-nonsense approach to achieving financial health and freedom. Ramsey's step-by-step plan, known for its simplicity and effectiveness, addresses common financial pitfalls and offers practical solutions for overcoming them. From creating an emergency fund to paying off debt and building wealth, Ramsey covers essential financial strategies that resonate with individuals at all stages of their financial journey.

Key Insights:

● The seven "Baby Steps" to achieving financial freedom

● The debt snowball method for paying off debt

● The role of behavior and discipline in financial success

As we conclude our journey through the pivotal finance books of 2024, it's clear that each author brings a unique perspective to the financial table, yet they all converge on a singular truth: understanding and managing our finances is crucial in today's ever-evolving economic landscape. From the deep psychological insights of Morgan Housel in "The Psychology of Money" to the timeless investment wisdom of Benjamin Graham in "The Intelligent Investor," these books offer a multifaceted approach to financial literacy.

Vicki Robin's call to align our finances with our values in "Your Money or Your Life," Rob Berger's blueprint for early financial independence in "Retire Before Mom and Dad," and Dave Ramsey's pragmatic strategies for overcoming debt in "The Total Money Makeover" collectively provide a roadmap for anyone looking to take control of their financial destiny.

In synthesizing the core teachings from these diverse yet complementary works, we find a comprehensive guide to financial empowerment. Whether your goal is to better understand the psychological underpinnings of your financial decisions, master the art of value investing, realign your life goals with your financial strategies, fast-track your journey to financial independence, or recover from financial setbacks, the insights from these pages are your beacon.

Let these books serve as your guides in transforming your financial future. Embrace their wisdom, apply their strategies, and step confidently into a future where you are the master of your financial journey.

Also Read:-

Recent Comments: